Attrition: The Key to Maximizing Your Revenue

Attrition is a key measurement in the security industry. Because revenue is measured in terms of recurring monthly revenue (RMR), your company’s attrition rate – the percentage of accounts you lose over a set period of time – directly affects your revenue. Potential buyers not only view your attrition rate as an indicator of your company’s overall health but, because acquisition value is most often measured as a multiple of RMR from “qualified” accounts, attrition is a key value driver, that impacts how much those buyers are willing to pay for your accounts.

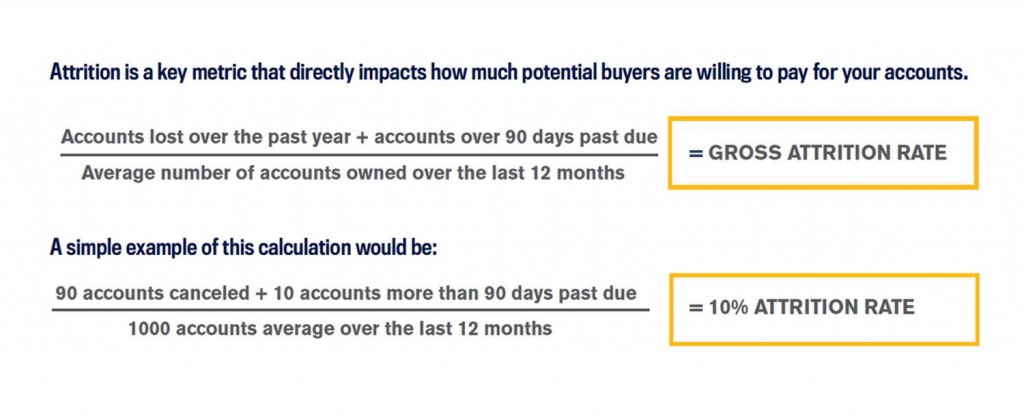

Despite its importance as a key industry metric, attrition is an often misunderstood, and miscalculated, concept. Simply defined, gross attrition is the total number of subscriber accounts your company loses over a period of time, typically measured in losses over the trailing year, divided by the average number of accounts your company owned over the same period. An accurate attrition calculation also reflects account aging. Any account more than 90 days past due is, by industry standards, considered canceled, regardless of whether either you or the subscriber has given notice.

Some attrition is unavoidable in the security industry. “Ordinary attrition” results from issues outside of your company’s control: customer moves, deaths, financial issues, and other customer life issues affecting demand for alarm services. Attrition can also be an indicator of customer dissatisfaction. “Extraordinary” attrition occurs either when customers cancel accounts for reasons related to your company’s performance, or when a competitor is able to win over your accounts with its marketing promotions or sales strategies. Non-payment, whether because of financial issues, customer service issues, or simply because the customer has stopped using the system and doesn’t want to pay for it any more, increases attrition as well.

A high-value company – one that industry-leading purchasers want to partner with – monitors its attrition rate and takes consistent steps to keep it at or below industry standards (To read more about high-value companies and their practices, see our blog post “Are You Ready” and our video.)

Why do high-value companies monitor and manage attrition?

First, because it just makes good business sense. It’s far more costly to gain a new customer – including the costs of sales and advertising, commissions, equipment, and installation – than it is to keep an existing one. Monitoring attrition on a regular basis helps your company identify and react to problems, both internal ones like customer service issues, record-keeping irregularities, and billing and collection problems, and external factors such as competition or economic conditions. Keeping detailed account records, including documenting the reasons for cancellations, provides you with valuable account information. This information can be used to identify and address service issues, develop procedures for record keeping, billing and collections issues to minimize account aging and loss, combat competition-related challenges, and some drivers of ordinary attrition, like economic factors and high relocation rates.

Second, companies with attrition rates at or below industry standards typically receive more value for their accounts. An accurate attrition rate provides a buyer with a general picture of your company’s economic health. It also gives the buyer some information from which to estimate the RMR it might have to replace on a yearly basis if it were to purchase your company or your accounts. And, of course, since value is often determined as a multiple of qualified RMR, an accurate attrition rate directly impacts the actual value you receive for your accounts.

Finally, monitoring attrition through sound record-keeping procedures allows you to provide a potential purchaser with critical account information at the due diligence stage. This gives a buyer not only the essential information it needs to evaluate the deal, but accurate and organized records will also assure a buyer that your representations are reliable.

Want more specifics on how high-value companies maximize both their revenues and the value they receive for their accounts? See our whitepaper “Transforming Your Company into a High-Value Business,” and watch this space for upcoming posts and videos.

Tags: attrition, recurring monthly revenue, RMR, multiples, acquisition (alarm company acquisition, alarm account acquisition), buying alarm accounts, sell/selling alarm accounts, sell/selling your alarm company, alarm dealer program/security dealer program.